Grow Your Business with Online Quotes

Effortlessly offer quotes for diverse insurance risks all integrated into your existing website.

Solution Benefits

Effortless Quoting - Embrace Automation Today

Our solution offers a user-friendly interface for hassle-free quotes. 24/7 Access, anywhere you are allowing your team and/or your clients convenience and accessibility. Boost productivity, save your team time (From days to seconds) and drive operational excellence via our automated Quick Quotes. Empower your customers by offering a self-service solution to explore various coverage options, compare products and prices and make informed decisions.

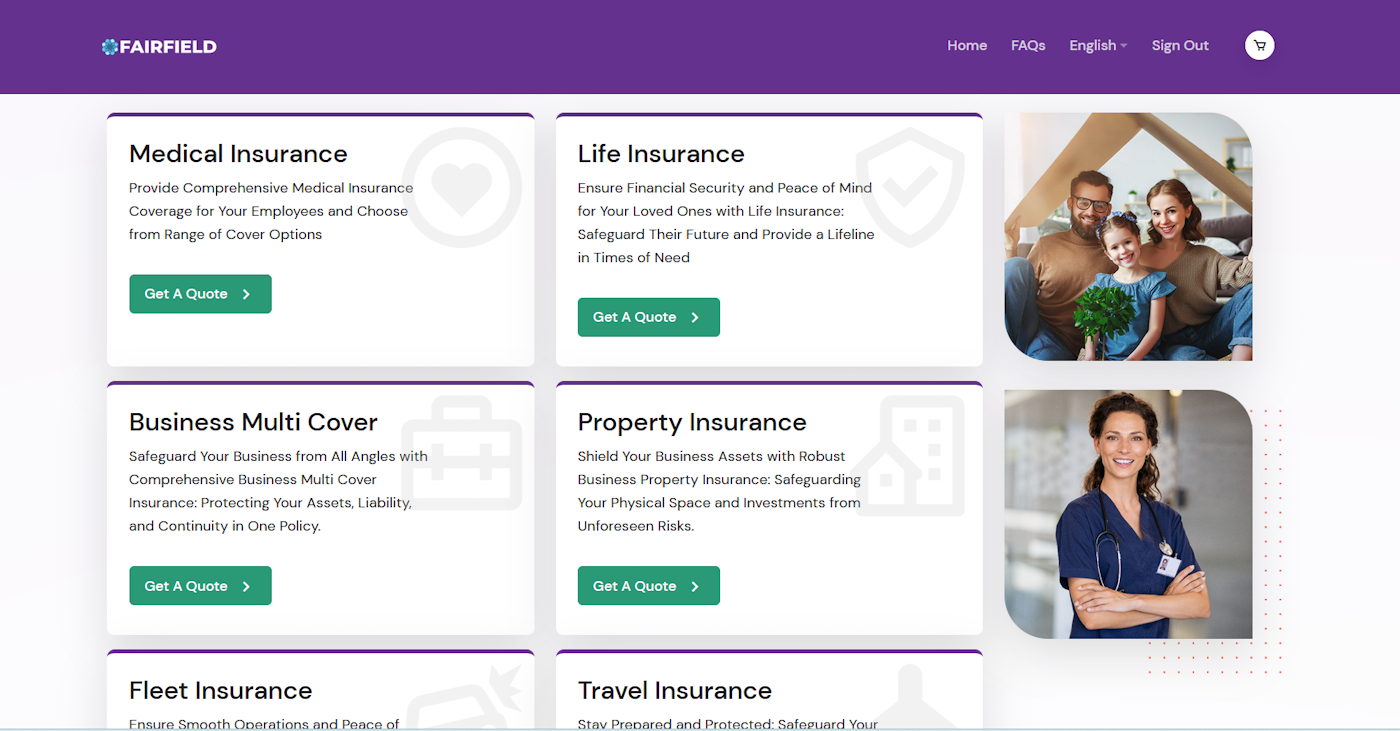

Discover Cross-Sell and Upsell Opportunities

Your One-Stop Insurance Solution: Quick Quote Hub Covers Multiple Risks with Tailored Options based on clients needs. The system can accommodate a wide range of policy variables, allowing customers to select coverage limits, deductibles, endorsements, and additional features that align with their risk profiles. This flexibility enhances customer satisfaction and ensures that policyholders receive appropriate coverage for their unique requirements.

Integrate with Your Website, CRM or Finance Systems

Integration enables automated data syncing, allowing real-time or scheduled updates between systems. This seamless flow of data and information enhances the Customer Experience, drives effective reporting and analytics and provides the flexibility to adapt and scale operations as needed.

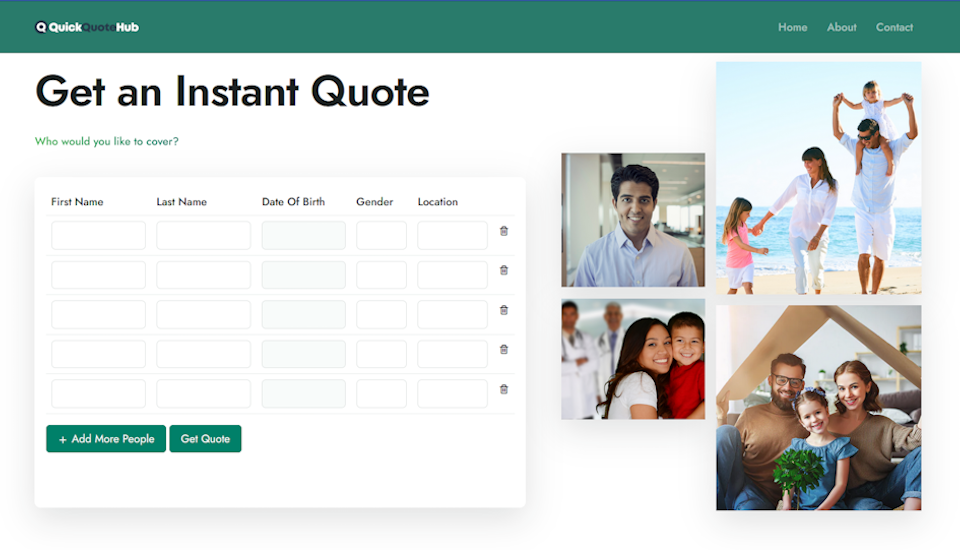

Built to Cater for Individual, SME and Corporate Customers

Whether you are targeting individuals seeking personal coverage, an SME looking to protect their business assets, or a corporate entity requiring comprehensive risk management solutions, our quote tool empowers you to easily provide customized insurance quotes.

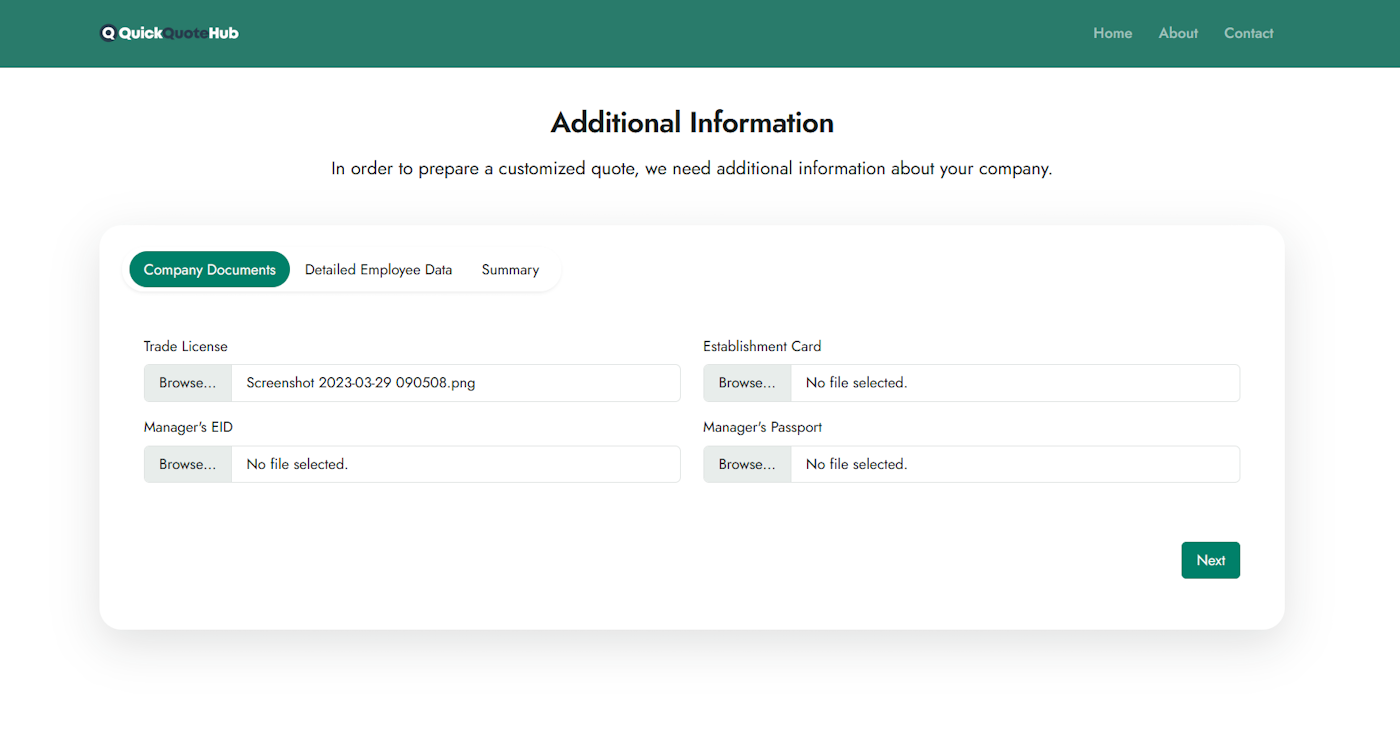

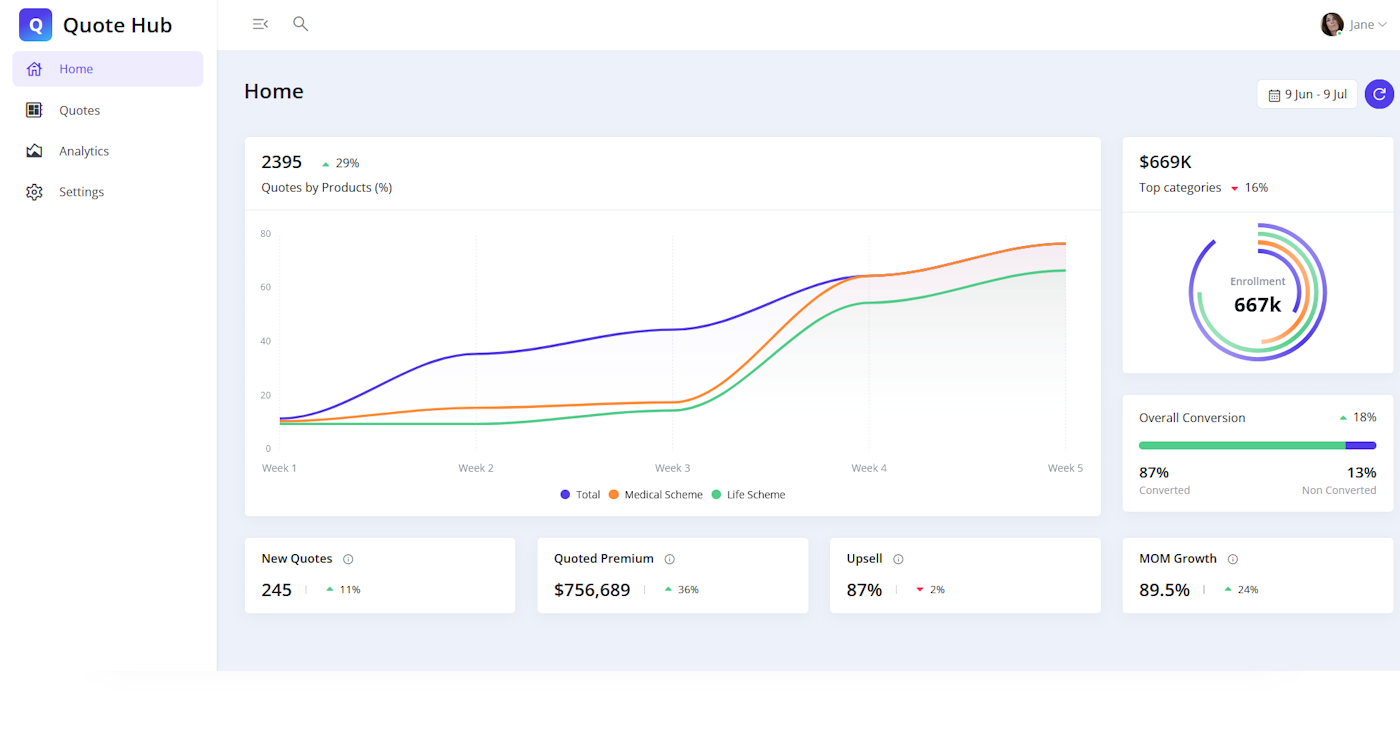

Manage and Configure Quote Process

With a user-friendly interface and advanced features, the admin tool simplifies the management of quotes, policies, and customer data. Insurance administrators can efficiently handle tasks such as policy configuration, pricing updates, and underwriting rules. The tool provides comprehensive insights through analytics and reporting functionalities, enabling data-driven decision-making.